Silver has long been regarded one of the most reliable assets, a hedge against inflation, and a way to obtain liquidity during economic emergencies. With gold rates constantly changing, selling your cash for gold can be quite a wise decision—if you know ways to get the best price. Knowledge the facets that determine gold's price, along side critical methods, may help you improve your profit.

Understanding Gold's Industry Value

Silver prices are pushed by world wide demand, geopolitical tensions, currency energy, and financial uncertainties. The price tag on silver is standardized in the international industry and cited in per-ounce measurements. To comprehend their current market value, check live silver prices through respected systems, such as for example Kitco or Bloomberg, which upgrade rates in real-time.

Statistics reflect that silver rates may differ significantly. As an example, the worthiness of 1 whiff of silver surged from around $1,500 in mid-2019 to over $2,000 by 2020 as a result of financial instability throughout the pandemic. Keeping conscious of the industry changes can immediately affect the quantity you get once you sell.

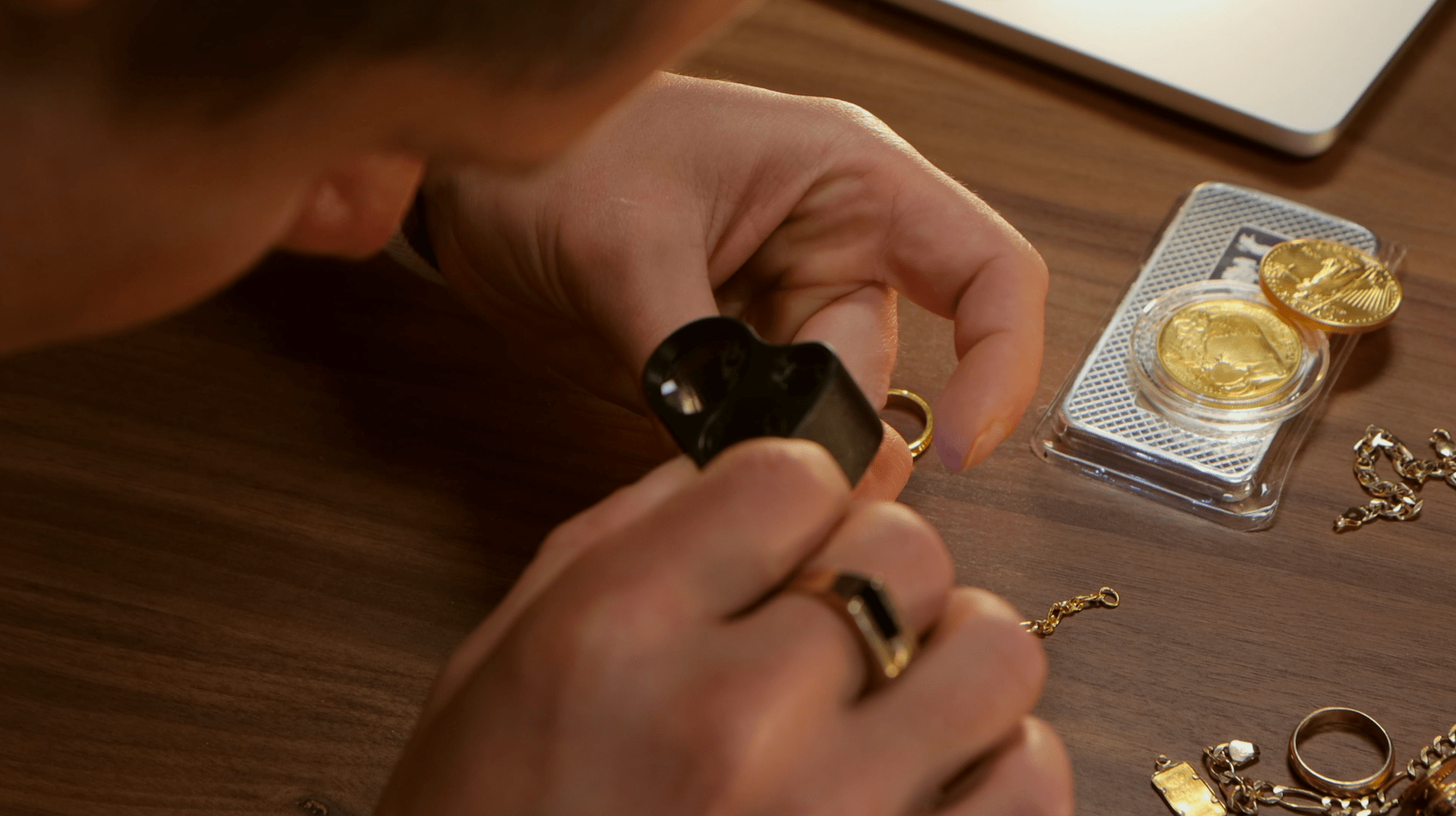

Measure the Purity of Your Gold

The karat (K) process methods the purity of silver, with 24K being 99.9% real gold. Gold pieces such as for example jewelry or ornaments tend to be alloyed with different metals to enhance toughness, lowering their true gold material and value. As an example, 18K gold includes 75% gold and 25% different metals.

Before you provide, ensure you know the love of your gold by checking the karat press or having it tested by a skilled appraiser. Visibility in love and weight is important for calculating probably the most accurate price.

Choose the Correct Method of Offering

Not all offering choices deliver the same return. Selling your silver on line to trustworthy customers, such as for instance bullion exchanges or particular gold traders, often offers better prices than pawnshops or jewellery retailers. Study indicates that pawnshops may possibly present 10-20% significantly less than silver dealers due to higher profit margins.

Moreover, prevent “gold parties” or unverified consumers providing cash offers, as they might undervalue your gold. A 2018 record highlighted that official silver merchants paid clients around 15% more than informal buyers.

Negotiate Based on Dissolve Value

The melt value presents the price of one's silver following it's dissolved down and processed in to real silver bullion. Suppliers should emphasis with this value, derived from weight and love, as a standard throughout negotiations.

Armed with understanding of the existing gold cost and burn price, confidently negotiate with customers for a reasonable offer. Assess multiple quotes to ensure the most readily useful deal.